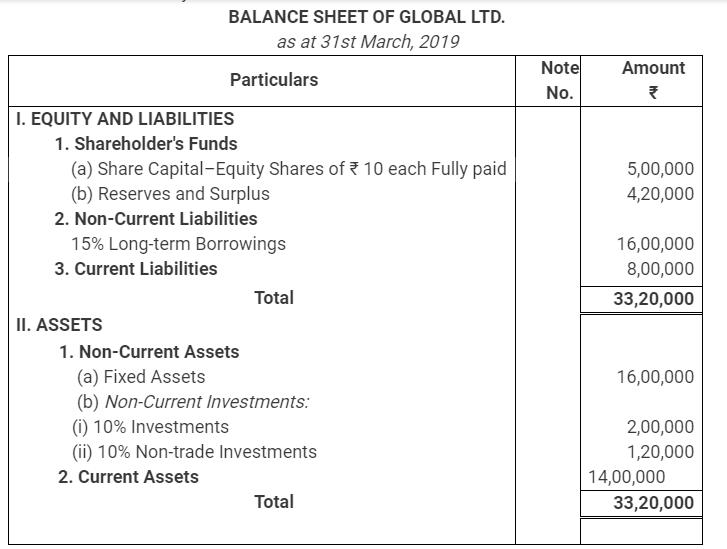

Leverage ratios are similar to liquidity ratios. However, this ratio indicates your profitability from the outstanding shares at the end of a given period.Ī leverage ratio helps you see how much of your company’s capital comes from debt and how likely it is to meet its financial obligations. The earnings-per-share ratio is similar to the return-on-equity ratio.

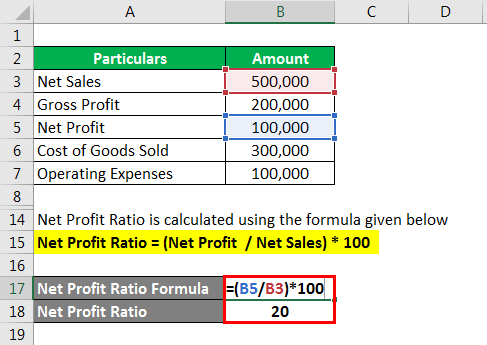

Earnings per share = net income ÷ number of common shares outstanding.The profit margin is an easy way to determine how much of your income is from sales. This ratio shows your business’s profitability from your stockholders’ investments. Return on equity = net income ÷ average stockholder equity.The return-on-assets ratio indicates how much profit companies make compared to their assets. Return on assets = net income ÷ average total assets.Common profitability ratios include the following: This ratio tells you how your current liabilities are covered by cash flow.Īccountants use profitability ratios to measure a company’s earnings versus business expenses. Operating cash flow ratio = operating cash flow ÷ current liabilities.However, it considers depreciation and calculates the likelihood of your business being able to pay interest on its debts. The cash coverage ratio is similar to the cash ratio.

Cash coverage ratio = (earnings before interest and taxes + depreciation) ÷ interest.For example, your accounts receivable and accounts payable aren’t considered because they represent future incoming client payments and future outgoing vendor payments. No other assets are considered in this ratio. This ratio tells you how capable your business is of covering its debts using only cash. Cash ratio = cash ÷ current liabilities.An increasing net working capital ratio indicates that your business is investing more in liquid assets than fixed assets. The net working capital ratio calculates your assets’ liquidity. Net working capital ratio = (current assets – current liabilities) ÷ total assets.

ACCOUNTING RATIO OUTSTANDING INVOICES PLUS

However, to measure “quick” assets, you only consider your accounts receivable plus cash plus marketable securities. This ratio is similar to the current ratio above.

ACCOUNTING RATIO OUTSTANDING INVOICES SOFTWARE

Understanding accounting ratios and formulas is worthwhile even if you choose accounting software to do much of the hard work for you. They offer quick ways to evaluate your company’s financial condition and identify trends and other data to guide critical business decisions. You can use them quarterly or annually, depending on your business type. What are accounting ratios?Īccounting ratios measure your organization’s profitability and liquidity and can show if it’s experiencing financial problems. But sticking with it can give you a clear picture of your company’s current financial health so you can make crucial decisions. Keeping up with various accounting ratios and formulas, as well as bookkeeping processes, can be time-consuming, tedious work. This article is for small business owners who want to use accounting ratios and formulas to understand their financial situation.Ī basic understanding of accounting is essential to running a small business.You can use accounting ratios quarterly or annually, depending on the type of business you own.Accounting ratios and formulas allow you to quickly evaluate your company’s financial condition.Keeping good records is essential to running a small business, but the bookkeeping process can be time-consuming.

0 kommentar(er)

0 kommentar(er)